Job security often means health insurance security

For many, a job provides compensation beyond a salary. Among other things, compensation packages generally include retirement plans, paid time off, and health insurance. For companies and organizations, these benefits ensure that employees are both healthy and satisfied with their jobs. Providing health insurance also creates a pool of employees who are provided with regular health check-ups and employer-covered costs of care. In other words, ensuring access to health care by creating a healthier insured population group benefits both the employer and employee.

Access to affordable and adequate health care is an important factor in determining how healthy – physically and mentally – a population is. Health insurance provides this access to health care. The Medicare-eligible population (those over the age of 65) is largely assumed to have health coverage. For insurance coverage under the age of 65, options include receiving government or public insurance, purchasing individual coverage, or receiving health insurance through employers. In 2019, about 46% of Minnesota workplaces offered Employer Sponsored Insurance (ESI), and 3 in 4 Minnesota employees eligible for ESI were enrolled (Agency for Healthcare Research and Quality, Center for Cost and Financing Studies, Medical Expenditure Panel Survey - Insurance Component, 2015–2019).

Impacts of COVID-19 on workforce

In April 2020, just after the start of the COVID-19 pandemic, 34% of Minnesotans reported a loss in employment income (Census Bureau, Household Pulse Survey). A loss in employment income has implications for living costs, life savings, and emergency costs. At its peak in April and May 2020, more than 500,000 continued unemployment claims were filed. Since many industries that laid off or furloughed employees were also contributing to insurance premiums, health insurance coverage for benefits eligible employees was impacted. Being uninsured exposes individuals and their families to broader care accessibility issues and the full cost of health care.

To help ease the burden with this, about 40% of Minnesota’s employers still continued to pay a portion of the insurance premiums for employees who were told not to work (Bureau of Labor Statistics, Table 11: Percentage of establishments that paid health insurance premiums for some employees told not to work, by state, n.d.), and public insurance markets created special enrollment periods to encourage the general public to get insurance coverage. Some of these solutions were only temporary or provided mild relief. Employers could decide the length or portion of health insurance premiums they would contribute to. And selecting a new insurer may have caused a disruption in employees’ continuity of care. Federally, COBRA protections ensure continuity of insurance, but under COBRA employees are responsible for the full amount of their monthly premium.

Who was likely to have been uninsured going into the pandemic?

Risk factors for COVID-19 have known to include several chronic health conditions including diabetes, obesity, asthma, cancer, COPD, and high blood pressure. Treatment and care of these chronic conditions rely on consistent and accessible health care. With capacities of hospitals and hospital staff tested with the onset of various COVID-19 spikes, even seeking care for one of these conditions could have been difficult.

Chronic health conditions combined with COVID-19 could make for an expensive hospital bill for those without insurance, with estimates ranging from $13,297 to $40,218 per stay.

Prior to the passage of the Affordable Care Act (ACA) in 2010, the uninsured population was high. About 1 in 10 Minnesotans were uninsured. Nationally, 1 in 6 were without insurance. After the implementation of the ACA, there was a strong decline in the share of uninsured individuals at both the national and state level. Statewide, the uninsured population dipped to 4.8% by 2016. That share remained relatively constant for a few years. The most recent data from the Small Area Health Insurance Estimates (SAHIE) program show that even going into the pandemic, a growing number of Minnesotans were becoming uninsured. This slight uptick may be due to a combination of factors, including the repeal of the individual mandate, increasing premium costs, and a smaller share of insurers on the individual market. In 2019, the share of Minnesotans uninsured increased slightly to 5.8%.

Prior to the pandemic, we saw differences by race, ethnicity, and geography in who was more likely to be uninsured.

A smaller share of Minnesota’s White (non-Hispanic) and Asian populations, and those of two or more races, were uninsured compared to all other races and ethnicities.

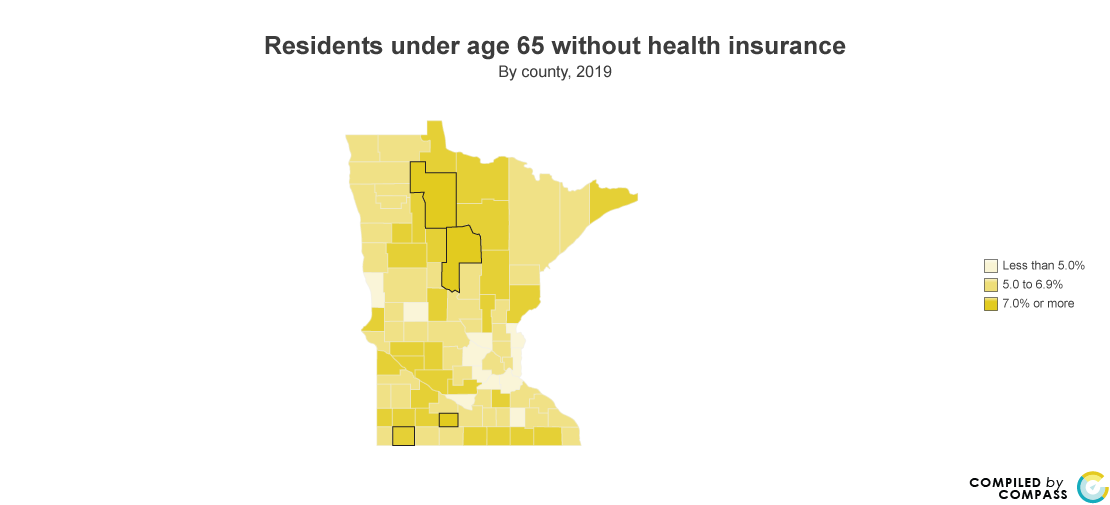

Prior to the pandemic, areas outside of the greater Twin Cities metro had higher shares of uninsured. Among the highest were the Northwest region at 7.7% of residents and the Southwest region at 7.4%.

Heading into the pandemic, Nobles, Watonwan, Beltrami, and Cass counties were among those counties with the highest uninsured rates in the state. In these counties, shares of uninsured were greater than 10%, matching pre-ACA statewide levels of uninsured.

Source:

U.S. Census Bureau, Small Area Health Insurance Estimates (SAHIE) Program.

From March 2020 through April 2020, Minnesota lost 12.4% of jobs. Job losses were concentrated in the fields of leisure/hospitability (-51.7%), other service jobs (-31.3%), retail trade (-16.6%), and educational services (-12.2%). In industries with higher concentrations of full-time salaried employees with health benefits, a loss in income could also mean a loss in health care coverage for employees and their families.

Health care is expensive, and being exposed to the unshielded costs of health care is a risk that can and should be mitigated. But Minnesotans who lost health insurance coverage due to a job loss have options to seek care. In a recent policy, the American Rescue Plan will expand insurance coverage in Minnesota to 44,200 newly eligible residents for tax credits and 3,500 more uninsured residents will now be eligible for $0 Marketplace coverage. For Minnesotans enrolling in a MNsure plan, this also means that monthly premiums will be capped at 8.5% of household income.

Resources

- Open enrollment for MNsure for 2022 runs Nov. 1 to Jan. 15: https://www.mnsure.org/

- Open enrollment for the Health Insurance Marketplace runs Nov. 1 to Jan. 15: https://www.healthcare.gov/

- COVID-19 Care for Uninsured Individuals: https://www.hhs.gov/coronavirus/covid-19-care-uninsured-individuals/index.html

- As the COVID-19 situation continues to develop, MN Compass is tracking a number of statewide and local level indicators.

- For more on COVID-19 from the Minnesota Department of Health: https://www.health.state.mn.us/diseases/coronavirus/index.html